HotelHub booking lead times up 9.88% across the year compared to 2023.

Average room rate per night up 3.91% since Q4 2023.

Average length of stay settles at 2.5 days in the hybrid era.

HotelHub’s regular index has been released today for the final quarter of 2024, along with a review of the more than 8 million hotel bookings made via their technology over the course of the year, revealing the ever-growing gap between the time of booking and check-in date for business travel hotel reservations.

The findings from HotelHub, the leading hotel technology provider to global travel management companies (TMCs), show that, on average, booking lead times reached 17.35 days for all bookings in Q4 2024, an almost 7% increase on the same period in 2023. Combined with data from across the year, the average booking lead time for 2024 closed out at 16.13 days, up 9.88% from 14.68 days in 2023. While international bookings have traditionally been booked earlier, the data shows the biggest increase in lead time has been for domestic bookings – with the annual gap growing 11.54%, from 12.91 days in 2023 to 14.4 days in 2024.

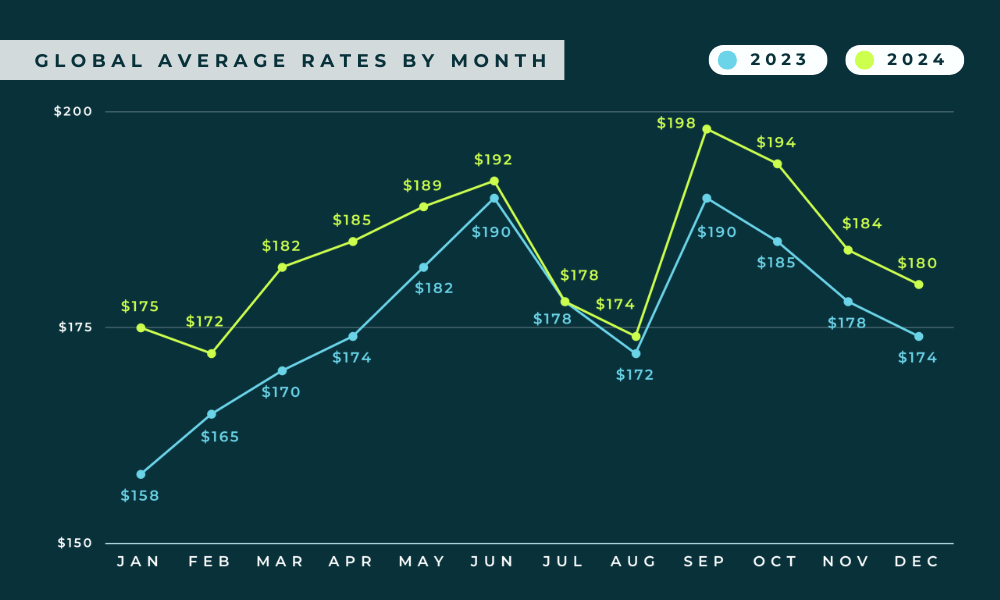

Across the year, the global average nightly rate for 2024 was $184, up 4.55% from $176 in 2023. While inflation was a major concern for business travel throughout 2024, HotelHub’s findings show that the rate at which prices are increasing is tapering off. 2024 began with hotel rates up 7.92% in Q1 compared to the same period in 2023; however, by Q4 2024, a significantly smaller increase of 3.91% was recorded versus Q4 2023 – a promising sign as we enter 2025.

Rates in many major centres of commerce remain much higher than the worldwide average but, on the whole, the year-on-year increases noted in previous periods are also shrinking.

In London, the most popular destination for HotelHub travellers, hotel rates were up 8.7% in Q1 2024, compared to Q1 2023; however, by Q4 this increase sat at 6.7%, going from $311 per night in Q4 2023 to $332 in Q4 2024. New York, which was the third most popular destination and is notoriously expensive, actually recorded price decreases in the second half of the year with rates in Q4 sitting at an average of $497 per night, down 2.2% from an average of $508 in Q4 2023.

Results from HotelHub’s 2024 data also reveal that average stay lengths have changed little since 2022, sitting consistently around 2.5 days. Pre-pandemic, this figure was about 3.5 days, which suggests that the subsequent, widespread hybrid-working models have had a lasting impact on the way businesses travel, with trips planned to coincide with the days colleagues and clients will be in the office.

Paul Raymond, Director of Business Development at HotelHub, commented:

“Following some turbulent years, the corporate world appeared to take a deep breath in 2024, waiting to see what would happen next. Our latest findings suggest that while businesses are continuing to travel despite the uncertainty, they are putting greater emphasis on the need to control and maintain comprehensive visibility of their hotel expenditures. If information is power, the ability to keep a close eye on travel spend can only lead to better decision making”

HotelHub continues to be the premier hotel booking platform, designed to support travel management companies with access to the most complete hotel inventory and best rates sourced from multiple partners. By consolidating content, reporting and payment tools into an end-to-end booking solution, HotelHub ensures greater efficiency and complete data visibility for its users.