-

Business travellers are making hotel bookings almost 19% earlier compared to the same period last year.

-

Average room rate per night up 3.62% since Q2 2023.

-

Average stay lengths at 2.5 days in line with hybrid work models.

HotelHub, the leading hotel technology solution provider for travel management companies and their corporate customers, has released its HotelHub Index for Q2 2024, an analysis of over 2 million hotel bookings made between April and June, revealing that businesses are shifting to more intentional travel in the face of uncertainty.

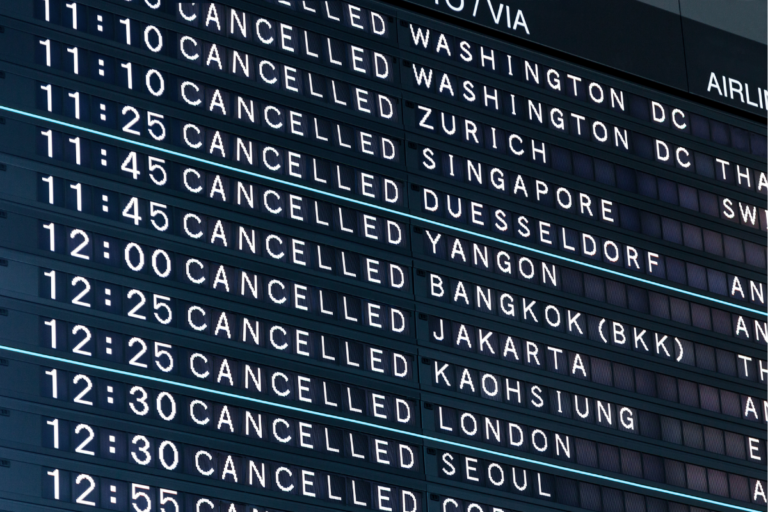

Overall booking volumes via HotelHub were up almost 7% in Q2 2024, compared to Q2 2023, suggesting that the financial and geopolitical climate is not dissuading corporates from travelling for business. However, one significant shift revealed by the data is that booking lead times are increasing.

In Q2 2024, bookings were made, on average, 16.68 days prior to check-in, up from 14.04 days in Q2 2023 — an increase of 18.8%. This change is even more marked for domestic bookings, jumping by almost 23% from 12.22 days in Q2 2023 to 14.97 days between booking and arrival in Q2 2024. Meanwhile, lead times for international bookings, which are traditionally longer, are up 2 days from 18.75 days in Q2 2023 to 20.75 days in Q2 2024, representing a 10.7% increase.

This variation in booking lead times is indicative of businesses taking a more prudent approach to travel, suggesting that fewer last-minute trips are being taken. Instead, corporates are likely planning further in advance to mitigate costs and to ensure the trips taken are justified.

HotelHub’s findings also reveal that average stay lengths have changed little in the post-pandemic years, sitting consistently around 2.5 days since 2022. With widespread hybrid working models, planning trips to coincide with days in the office is a clear consideration for businesses.

While inflation remains a concern for business travel, HotelHub’s findings suggest that the steep rate increases which have marked the industry over the past couple of years are starting to slow down.

Between April and June this year, the global average nightly rate booked via HotelHub was $189 (USD). That is just 3.63% up on the same period in 2023 – a significantly smaller increase than the 9.64% observed between Q2 2022 and Q2 2023 or the 7.92% recorded in Q1 2024. Rates in many major centres of commerce remain much higher than the worldwide average but, on the whole, the year-on-year increases noted in previous periods are also shrinking

In New York, the average rate booked in Q2 was $432 per night, up 5% from $411 in the same period last year; however, this is a considerable improvement on the almost 12% increase observed in Q1 2024.

Meanwhile some key business destinations have recorded almost negligible changes between the second quarters of 2023 and 2024, including Stockholm and Chicago which showed no change in their average rates ($199 and $317 respectively) and Paris which went from an average of $251 in Q2 2023 to $250 in the same period this year.

Paul Raymond, Director of Business Development at HotelHub, commented:

“It is encouraging to see signs of a slowing in rate growth trajectory; however, these are still uncertain times for the global economy and, with the US election looming, it may be some time before we know whether this will be a continuing trend.

It is understandable that many businesses are taking a more conservative approach to travel and we continue to work with our partners to navigate the shifting landscape by providing flexible booking technologies that reinforce travel policies and optimise opportunities for cost savings.”

HotelHub continues to be the premier hotel booking platform, designed to support travel management companies with access to the most complete hotel inventory and best rates sourced from multiple partners. By consolidating content, reporting and payment tools into an end-to-end booking solution, HotelHub ensures greater efficiency and complete data visibility for its users.